Feie Calculator Fundamentals Explained

Wiki Article

Feie Calculator Things To Know Before You Buy

Table of ContentsUnknown Facts About Feie CalculatorThe Best Guide To Feie CalculatorFeie Calculator for BeginnersThe Basic Principles Of Feie Calculator About Feie Calculator

He offered his United state home to develop his intent to live abroad permanently and applied for a Mexican residency visa with his wife to aid fulfill the Bona Fide Residency Examination. Additionally, Neil secured a long-term residential or commercial property lease in Mexico, with plans to ultimately buy a property. "I currently have a six-month lease on a house in Mexico that I can prolong an additional 6 months, with the intent to buy a home down there." Neil points out that getting residential or commercial property abroad can be challenging without very first experiencing the place."We'll absolutely be beyond that. Even if we return to the United States for medical professional's appointments or service phone calls, I question we'll invest greater than 1 month in the United States in any provided 12-month duration." Neil emphasizes the relevance of stringent monitoring of united state sees (Bona Fide Residency Test for FEIE). "It's something that people need to be truly attentive regarding," he claims, and recommends expats to be careful of common errors, such as overstaying in the united state

Feie Calculator Things To Know Before You Get This

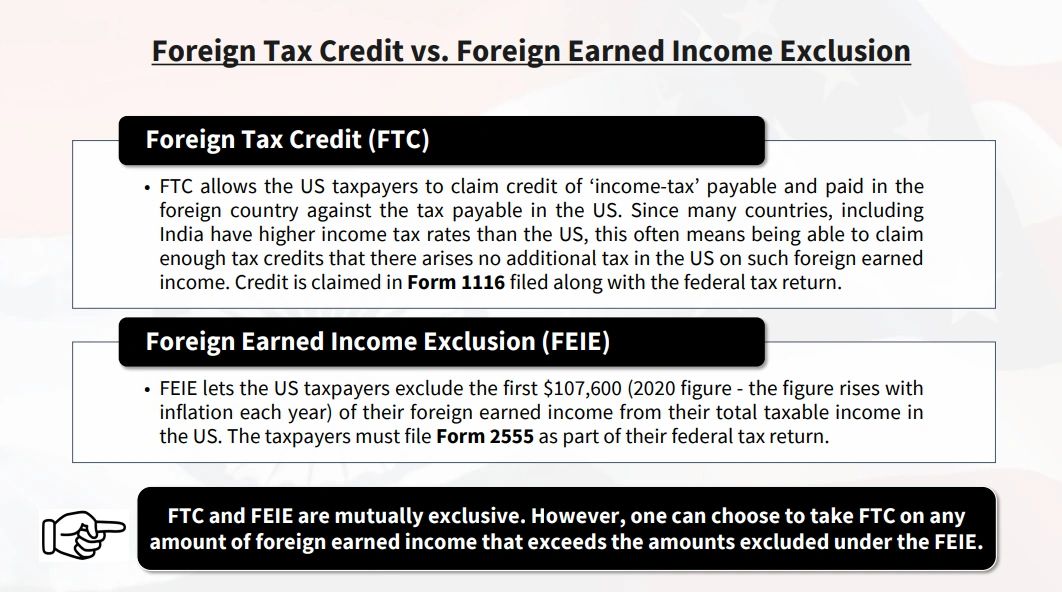

tax obligations. "The reason that united state tax on around the world earnings is such a huge deal is because many people neglect they're still based on U.S. tax also after relocating." The united state is just one of minority nations that taxes its residents no matter of where they live, indicating that even if an expat has no income from U.S.income tax return. "The Foreign Tax Debt allows people operating in high-tax countries like the UK to offset their united state tax liability by the amount they've currently paid in tax obligations abroad," states Lewis. This ensures that expats are not tired twice on the very same earnings. However, those in reduced- or no-tax countries, such as the UAE or Singapore, face added obstacles.

The Single Strategy To Use For Feie Calculator

Below are several of the most regularly asked concerns concerning the FEIE and other exclusions The International Earned Income Exclusion (FEIE) enables united state taxpayers to leave out as much as $130,000 of foreign-earned income from government revenue tax, lowering their united state great site tax obligation. To get approved for FEIE, you must meet either the Physical Existence Test (330 days abroad) or the Authentic House Test (verify your key house in an international country for a whole tax obligation year).

The Physical Existence Examination needs you to be outside the united state for 330 days within a 12-month duration. The Physical Existence Test also calls for united state taxpayers to have both a foreign income and an international tax home. A tax home is specified as your prime place for company or work, no matter your family members's house.

Facts About Feie Calculator Uncovered

An earnings tax obligation treaty between the united state and another nation can help protect against double taxes. While the Foreign Earned Income Exemption reduces taxed revenue, a treaty may supply extra advantages for eligible taxpayers abroad. FBAR (Foreign Savings Account Record) is a required filing for united state people with over $10,000 in foreign financial accounts.Qualification for FEIE depends on meeting certain residency or physical visibility examinations. He has over thirty years of experience and now specializes in CFO solutions, equity payment, copyright taxation, marijuana taxation and separation related tax/financial preparation matters. He is a deportee based in Mexico.

The international made earnings exemptions, sometimes described as the Sec. 911 exemptions, leave out tax on salaries made from working abroad. The exclusions comprise 2 parts - an income exclusion and a real estate exclusion. The complying with FAQs review the benefit of the exemptions including when both spouses are expats in a basic fashion.

An Unbiased View of Feie Calculator

The revenue exemption is currently indexed for inflation. The maximum annual revenue exemption is $130,000 for 2025. The tax advantage excludes the earnings from tax obligation at bottom tax obligation prices. Previously, the exemptions "came off the top" reducing revenue topic to tax at the leading tax rates. The exclusions may or might not reduce income utilized for other functions, such as IRA limitations, child debts, individual exemptions, etc.These exemptions do not excuse the earnings from US taxation yet simply offer a tax obligation decrease. Note that a bachelor working abroad for every one of 2025 that earned about $145,000 without other income will certainly have gross income reduced to absolutely no - properly the exact same answer as being "free of tax." The exemptions are computed every day.

Report this wiki page